Revenue and profit are financial terms used to determine whether a business is succeeding or failing. They have a relationship, and some people may interpret them to mean the same thing. Yet, they differ in unique ways.

Revenue is all the money a company makes from its business activity. In revenue, there are no deductions as it includes all income the company generates, no matter how small. On the other hand, profit is the total amount left after deducting costs from the revenue.

This article explains more about the difference between revenue and profit and their relationship. Now to the details.

What is Revenue?

Revenue is the total income your company generates from all sales of its major products and services to the public within a time frame. You can calculate revenue either daily, monthly, or yearly.

When calculating the revenue, you can’t make any deductions. You have to sum up any income your company generates, no matter how small, to arrive at the total revenue.

However, your revenue is not an all-inclusive measure of your business’s financial status.

You can’t determine your return on investment based on revenue alone since it does not include deductions. You will need more than that, which brings us to the term, profit.

What is Profit?

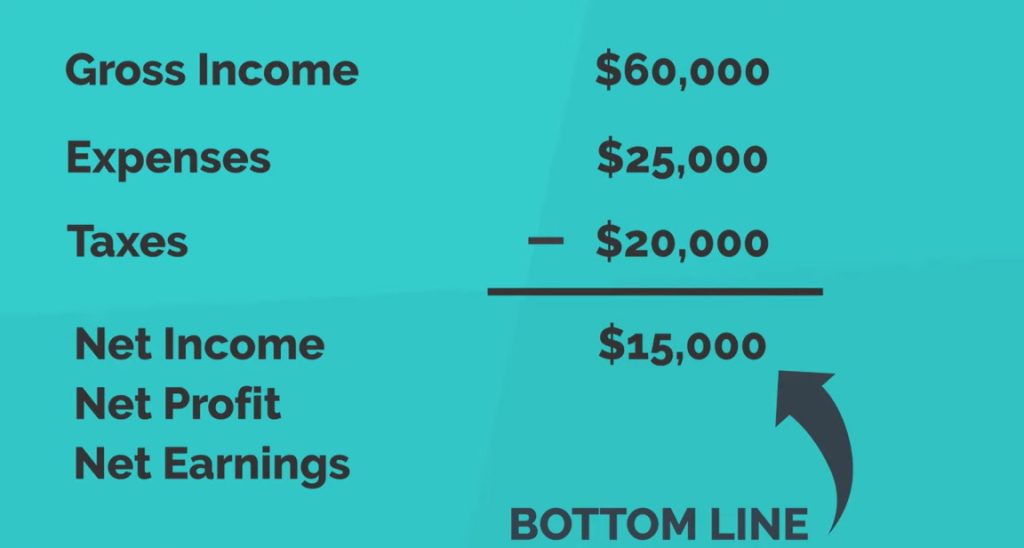

Profit is defined as the total amount of money you have left after making all deductions (both operational and variable costs) from your total revenue.

It’s known as net profit or bottom line in any income statement.

You can further break profit down into four subcategories:

- Gross Profit (Gross Income): Gross profit is one of the most general forms of profit. It’s the amount of money you have left after you subtract the cost of the products sold. For example, if you sell a shirt for $5.00, and it costs $2.00 to make. Then your gross profit is $3.00.

- Operating Profit: Operating profit takes your business expenses into account to give you a more in-depth look at the amount of money you made. To calculate operating profit, subtract the operating costs from your gross profit.

- Pre-tax Profit: Pre-tax profit is the amount of money you have left over before taxes are deducted.

- Net Profit: Lastly, net profit is the amount of money you have left over after subtracting all your expenses, including taxes.

Revenue vs. Profit: Understanding key differences

Revenue will always be more than profit. A good way to remember this is to look at your earnings report. Revenue will typically be at the top of an earnings report or income statement because it’s the total amount of money you made before you make any subtractions. Profit will be at the bottom because it’s the sum left over after subtracting all your expenses.

Revenue is essential for seeing your total income. But profit allows you to see how much money you gain after paying all your expenses.

Another key difference is that a company can have revenue but generate zero or little profit. When a company makes sales from its primary goods and services, it generates revenue.

However, when other expenses get deducted from that revenue, it becomes evident that there is little or no profit.

The relationship between Revenue & Profit

There is a strong relationship between profit and revenue, and they depend on each other in the following ways.

If a business doesn’t generate enough revenue from its products and services and its business costs continue rising, it will have low profits. Hence, low revenue and high business costs lead to a small profit margin.

Business costs include the cost of goods sold, materials, wages for labor, operating costs, materials, and indirect costs. When revenue is constant and the business cost is low, the brand will experience an increase in profit.

However, it’s essential to ensure that reducing business costs doesn’t affect the quality of the products. Any such mistakes will lead to negative reviews, low patronage, and a fall in market share.

Bottom Line

Revenue and profit are two essential terms found in the income statements of businesses. While revenue is at the top and accounts for all sales, profit sits at the bottom after deducting all expenses from revenue.

Hence, the goal of every business should be to increase its revenue while reducing the business cost to make more profit.